Isn't It a Pity? - An Outlook of the US Economy

Topics: Federal Reserve and Consumer Spending

Hello all. I wanted to provide a heads-up that I am now thinking of publishing posts biweekly. Especially with starting my career, I need more time to recharge over the weekends rather than focusing on my newsletter. With this extra time between posts, I hope to publish higher quality and longer posts. If you want to keep in touch with me between posts, feel free to reach me on Twitter. Anyways, happy Sunday!

#1 - Federal Reserve Beige Book

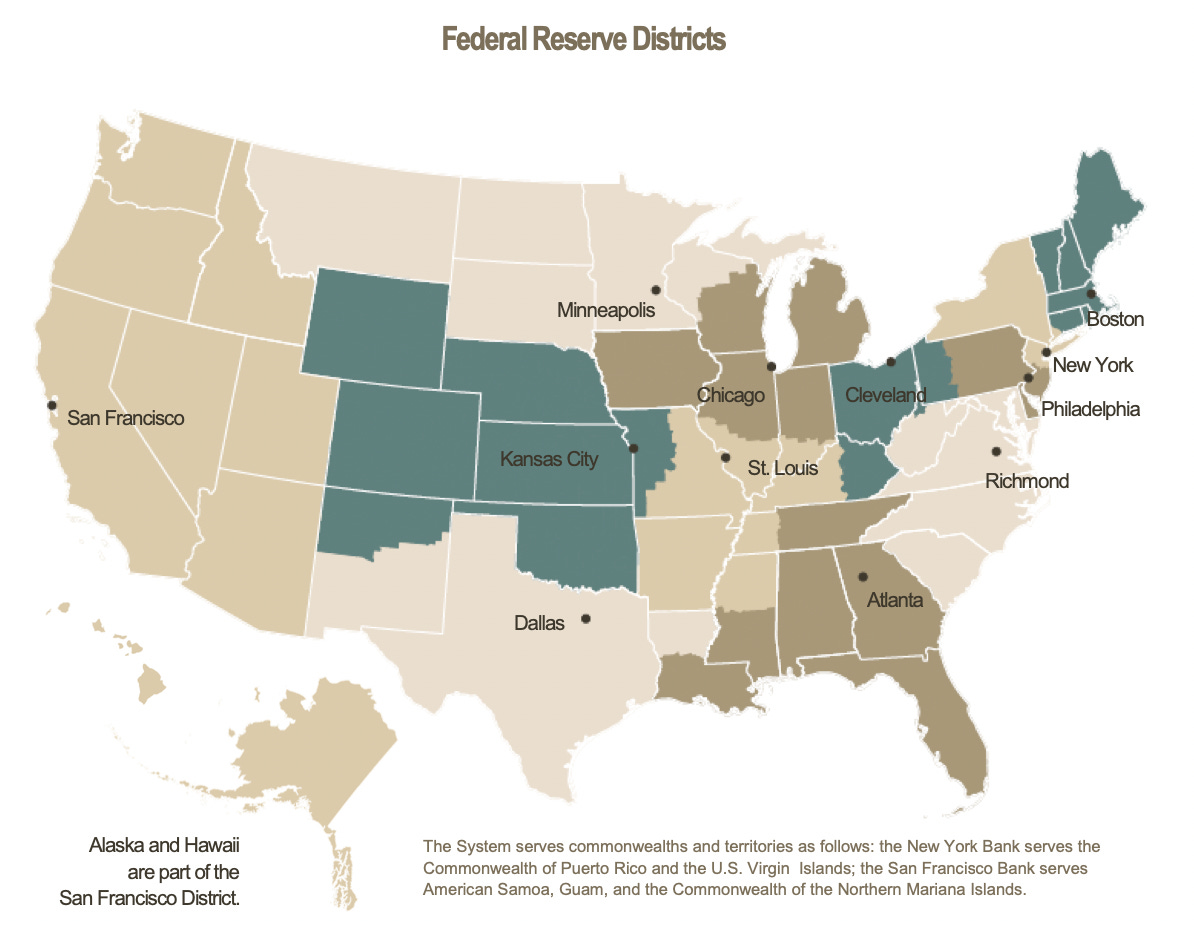

The Federal Reserve posted its Beige Book earlier this week, which analyzes the economic conditions across the 12 Federal Reserve Districts. As much as I would write about all the districts, I wanted to focus on Richmond due to its proximity to me. How selfish of me! It is important to note that Richmond is the 4th biggest Federal Reserve bank in terms of assets. That really surprised me when looking at all the other cities that each Federal Reserve District resides in.

Prices and banking were two areas in the Fifth District that piqued my interest. According to the Beige Book, prices are continuing to increase with time. As with all of the other districts, inflation continues to be an unresolved problem. The Fed is still taking this seriously as it is predicted that the central bank will do another 75bp rate hike in November. Cheap money is becoming a thing of the distant past as the Fed is aggressively trying to get inflation under control.

What caught my eye with banking and finance is that loan delinquency rates are increasing. What this means is that borrowers are failing to make their loan payments on time. Although, it is pointed out that loan quality “continued to be stable”. As with most of my posts, I end with the conclusion that consumers are having a hard time. This continues to be true on a macro-scale (the US and globally) as well as on a micro-scale (1 Federal Reserve district). These Beige Books provide a good overview of how different parts of the US are performing and I highly recommend checking them out.

#2 - American Express CEO: 'We're not seeing any changes in consumer spending'

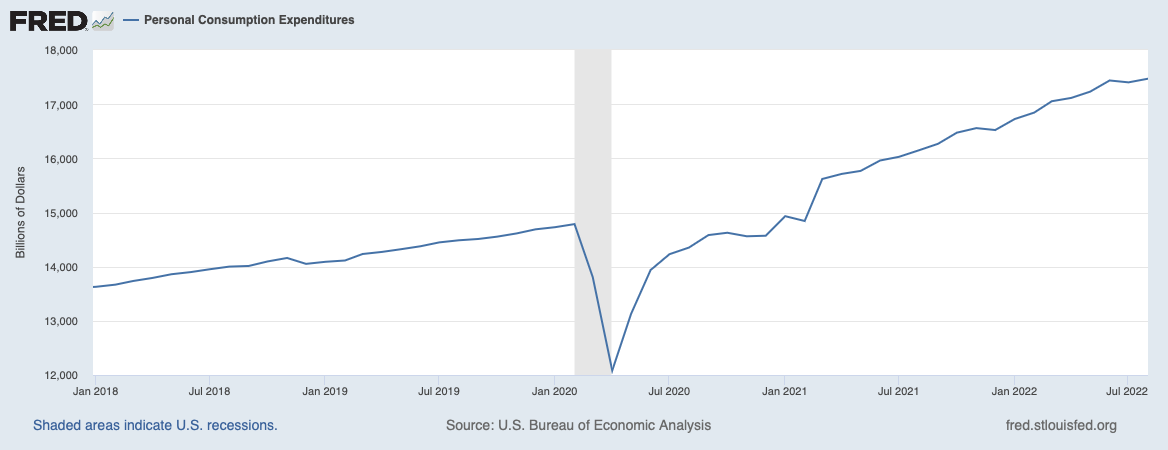

Stephen Squeri, the American Express CE0, brought up that “We're [American Express] not seeing any changes in consumer spending” upon the release of the company’s Q3 earnings. On a quick check of the FRED website, consumer spending seems to be flattening a touch. In other words, no changes!

However, what can we expect going forward? Will the recent volatility of the economy and financial markets incentivize more consumers to save rather than spend? Will inflation even allow people to save with everything being so expensive? As with most financial articles right now, there are more questions than answers at the moment. Isn’t it a pity? It is very hard to find a signal amidst all the noise currently.