Only a few people can completely alter the financial markets through just a few words. One of those people is Jerome Powell, the Federal Reserve Chairman, and the markets all had their eyes on him early last week. Powell spoke at the Economic Club of Washington DC and said that the Federal Reserve is committed to disinflation and will react appropriately when more economic data becomes readily available. During the interview, you can also tell how careful he is with his words. Even a small slip of the tongue could scare the financial markets.

Even despite the strong job report released earlier this month, Powell does not see that as a sign to stop rate hikes. Additionally, Powell pointed out that the Fed will do anything in its power to reach the inflation rate target of 2%. Given the high levels of inflation right now, the process of getting to 2% will be an extensive journey. The Chairman admits this, even stating that this goal will likely be achieved in 2024. In his eyes, keeping the inflation target at 2% is maintaining price stability.

From my perspective, one of the most interesting topics mentioned in the interview was independence and transparency. The central bank was not created to pursue political interests, but rather to be an entity that could support banks and the economy during a downturn. In other words, the Fed was created to develop some means of stability. The history of the central bank is extensive, as it originated through the signing of the Federal Reserve act by Woodrow Wilson in 1913.

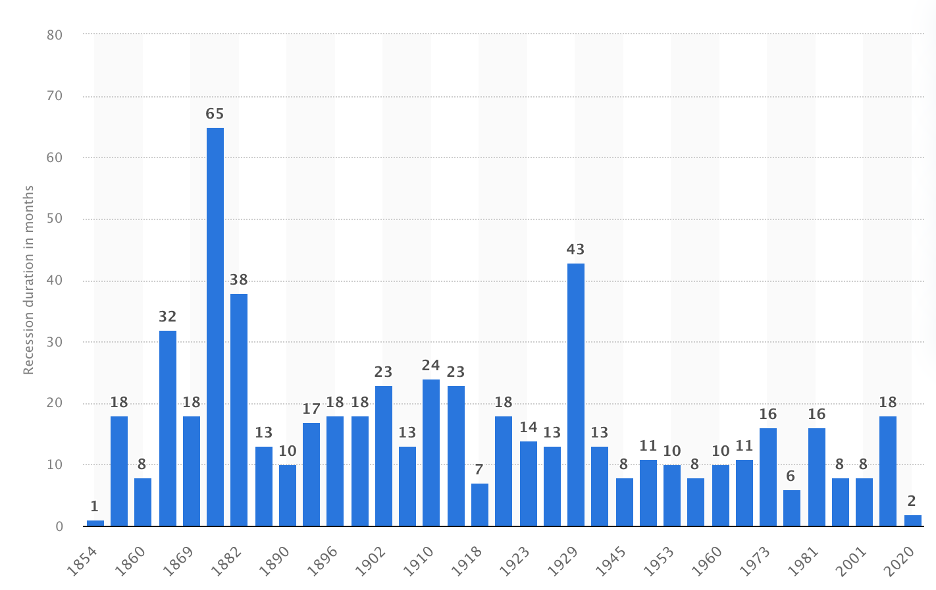

Prior to 1913, the US had significant issues with recessions and bank panics. Since the origination of the central bank, we are on a downward trend in the frequency and length of recessions. Other than during the Great Depression (1929 – 1939), the US economy has been a lot more stable compared to the 19th century.

With all of that being said, the Federal Reserve needs to be a transparent and independent institution. Powell noted that “we want the public to understand how we think” so that potential rate hikes are already priced into the market. The central bank needs to be transparent to create a general sense of certainty in the markets. If the markets can’t anticipate the central bank’s actions, market fluctuations would be severe. Additionally, a stable economic system could not be maintained if taken over by political motives. Central bank independence is a necessity so that they can pursue monetary policies to keep prices stable and unemployment low.

Personal Reflection

So, what did I ultimately take away from this interview? As I have said in many posts before, it is challenging to be one of the most important economic figures in the world. Being the Federal Reserve Chairman grants you the ability to change the world economy. A scary thought, huh? I thought this interview was significant as I rarely see clips or videos of Powell being publicly interviewed.

Even with the pressures of being the Chairman, he was cool under pressure. Imagine if someone in that role appeared scared or unprepared. Perhaps we take for granted what a calm figure at the helm of the Federal Reserve can do for an economy.

Powell mentions that there is still a “significant road ahead” to get inflation down. We are still far away from an environment where prices are stable. Although, some sectors of the economy are already getting inflation down significantly. I feel confident in Powell’s vision for the future, especially after watching this interview. Unless he put on an Oscar-worthy performance by underestimating the potential determinantal effects of extended high inflation and quantitative easing.

Sources: