Happy holidays everyone! I can’t believe that we are nearing the end of 2022. Near the beginning of this year, I began posting through Substack and it continues to be an amazing experience. I just wanted to say thank you to all the readers of Money Buzz and I am excited to continue writing through 2023. Cheers!

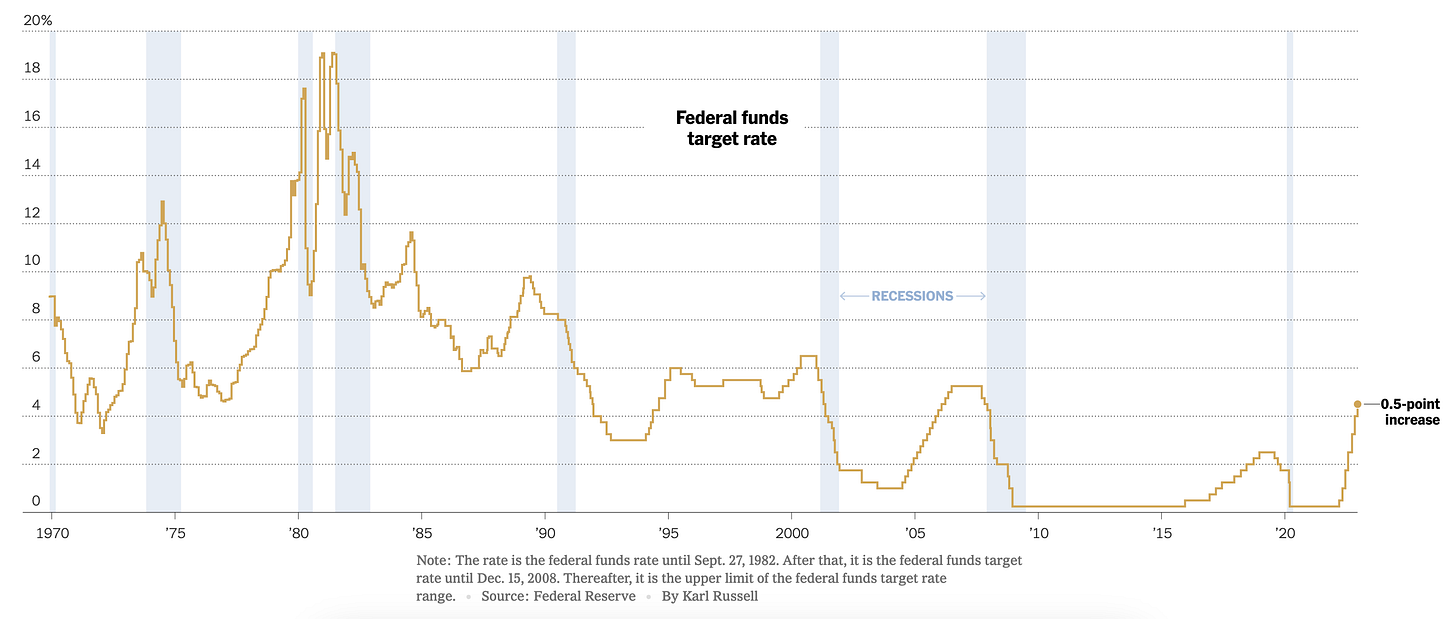

#1 - The Federal Reserve signals more to come even as it slows rate increases.

Inflation fell to 7.1% in November, which is the lowest that inflation has been last year. When compared to November 2021, inflation is up (scrambles through notes and papers) by 0.3% year over year. Amidst all of these rake hikes and such, inflation is still pretty high. Although, Wall Street and the markets have been seeing this as a win (at the time of writing this - 12/14). With inflation hopefully easing and with another Fed rate hike, the time of high inflation could soon be coming to an end. Every consumer on earth wishes this because of how hard inflation is hitting people’s wallets.

The increase in the Federal funds target rate still represents the Federal Reserve’s commitment to battling inflation. From what is rumored, these rate increases are not done yet. Federal Reserve officials are “now expecting to raise their policy interest rate to 5.1 percent by the end of 2023”. By attempting to cool the economy, who knows what adverse effects that we may undergo.

High borrowing costs will slow down economic growth and activity, but high inflation needs to be solved sooner rather than later (in my opinion). We may be close to entering into a significant recession, but not addressing inflation before that occurs will only amplify the negative effects of an economic downturn. With potential issues like unemployment and a lack of business investment running in tandem with high inflation, that is a tell-tale formula for a financial disaster.

#2 - Forget Stock Predictions for Next Year. Focus on the Next Decade.

In previous posts, I mentioned how bad economists and Wall Street are at forecasting the future. However, I think I actually underestimated how bad they are at doing so. Jeff Sommer, a finance and economics writer, stated that “the median Wall Street forecast since 2000 had missed its target by an average 12.9 percentage points a year”. To put this into perspective, imagine how poor this prediction is when applied to a weather forecast: “A meteorologist says the high temperature the next day will be 25 degrees Fahrenheit and it will snow, so you dress for a winter storm. Actually, the temperature turns out to be 60 degrees and the skies are clear”.

It is a scary thought that people deemed as “financial experts” are not consistent with short-term predictions. If Wall Street’s historical performance when it comes to predictions was applied to any other industry, criticism would be more apparent. If any lesson can be learned from this, it is that taking Wall Street’s estimates at face value is never a good idea. When looking at a Wall Street firm’s price target for a company, it is important to be skeptical. Ask questions like “Why is this firm’s price target of this company so high?” or “What is a more realistic price target for this company?”.

Especially when it comes to price targets, Wall Street firms do not like to hand out downgrades. They want to remain on good terms with companies in order to maintain any sort of business relationship. These are just small things to always keep in mind when you need to make your own prediction or opinion. Perhaps I went on a small tangent here, but it is vital to do your own research and not trust numbers or headlines at face value. Understanding and interpreting the world around you is a key skill.