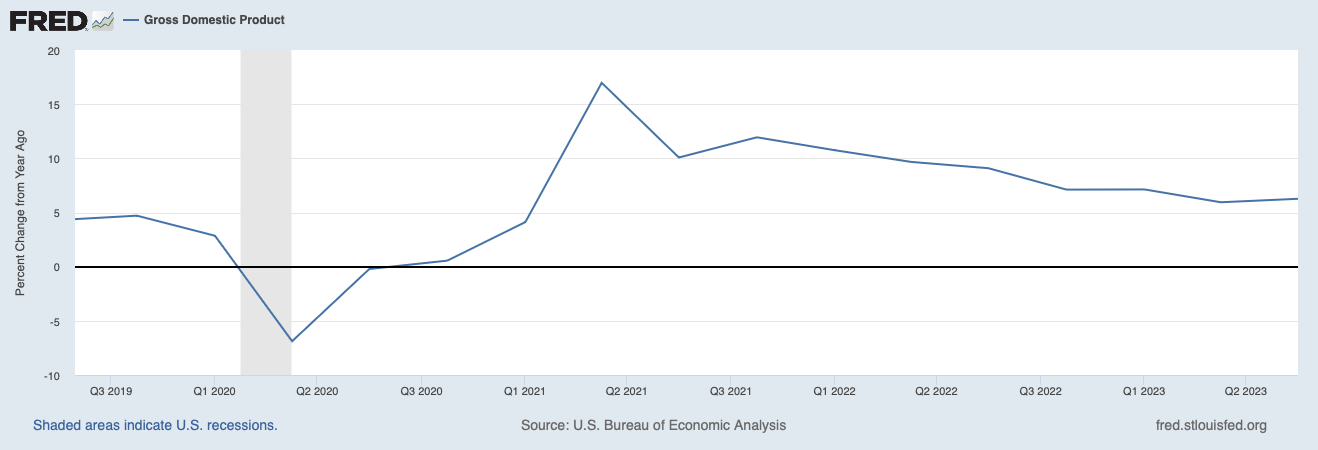

Judging how the economy is doing is a tough task. On my Saturday night, I read a piece by John Cassidy, a staff writer for the New Yorker, about how economists poorly predicted how the economy would perform in 2023. This past year, we feared that rising inflation, the hike of interest rates, and the increase in public debt could pull our economy into a deep recession. Despite all of this, the economy is growing and we are in a better place than anyone really expected (refer to Figure 1). John Cassidy agrees with this sentiment and goes as far as to say that “the fact that many people are still bummed about the price of groceries and the level of mortgage rates shouldn’t be allowed to obscure what is shaping up as a historic victory over inflation”.

Figure 1: Gross Domestic Product Change

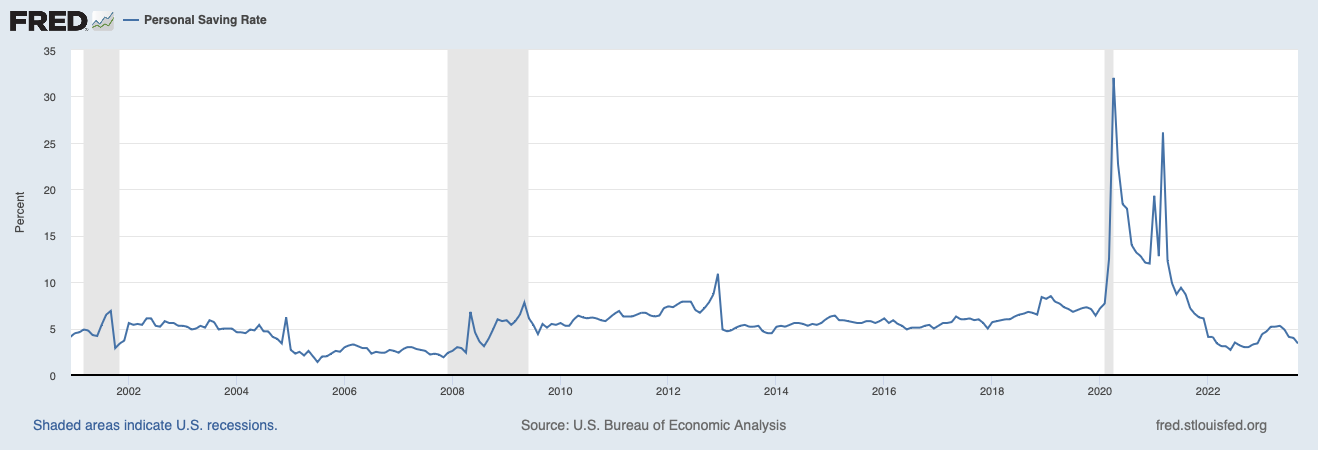

Figure 2: Personal Saving Rate

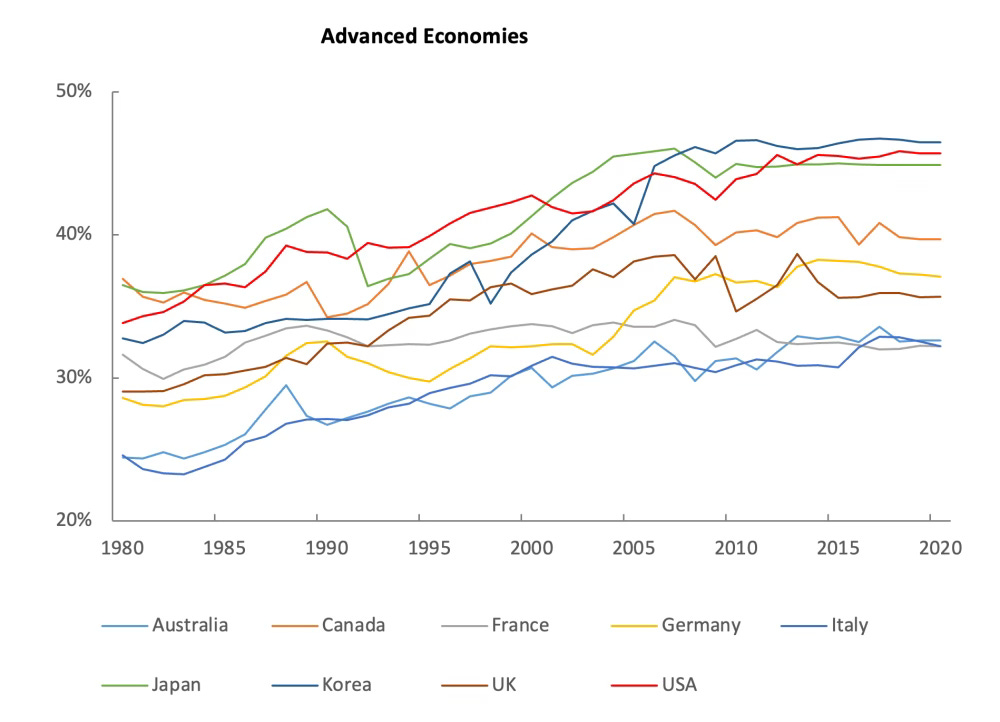

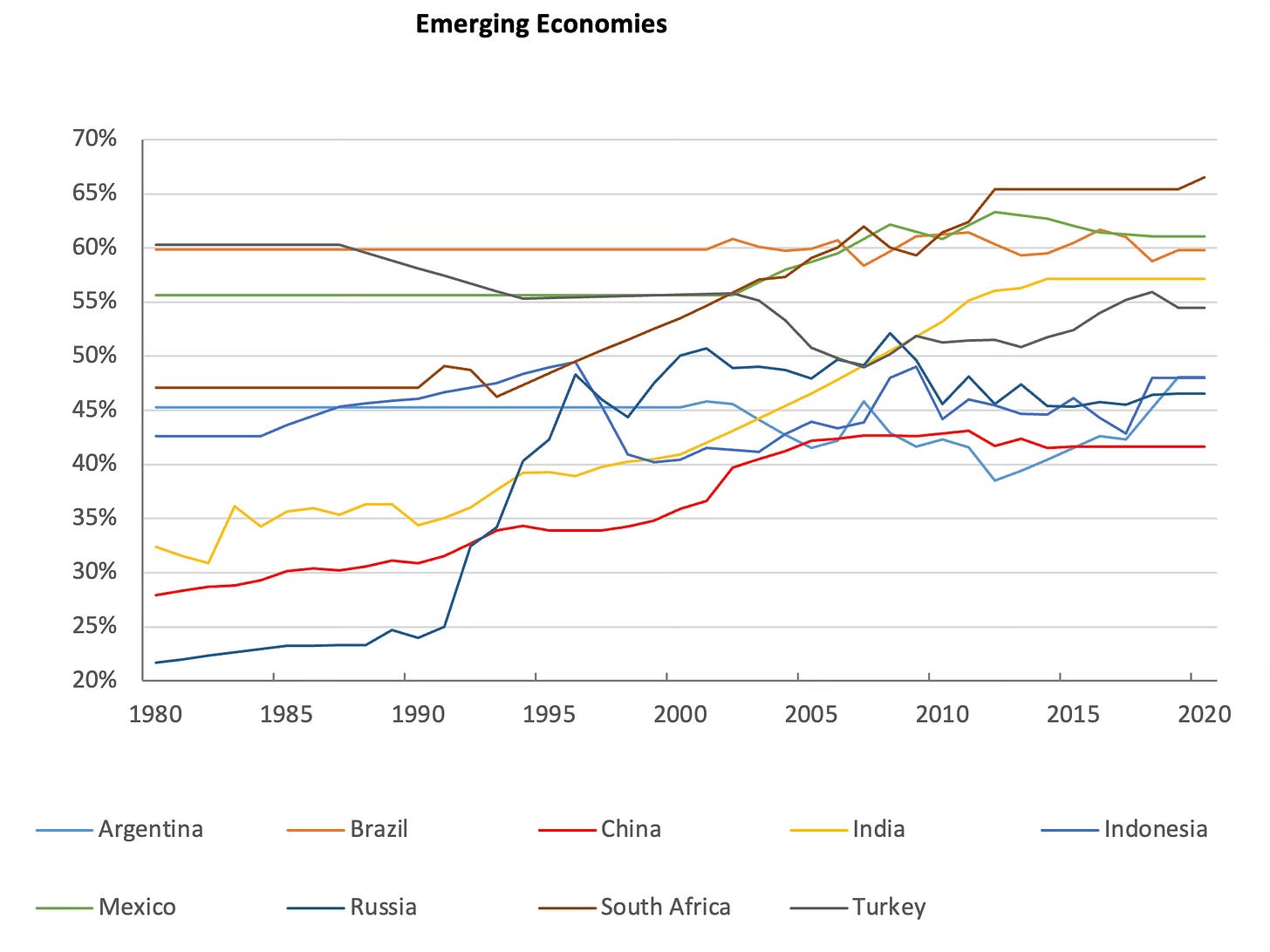

Yes, the economy is doing better than expected. However, the economy should be judged on a multitude of different variables. I think people are warranted in feeling “bummed” about the price of groceries and other necessities such as rent. Paying more in expenses lessens dispensable income. Thus, also reducing personal savings. People are saving less compared to before the COVID-19 pandemic occurred (refer to Figure 2). This could be a temporary change, but it could have devastating long-term effects for many. Not only this, but the top 10% income share continues to grow (refer to Figures 3 and 4). The economy is growing, but for whom? We may be experiencing a “historic victory over inflation”, but the economy is still in rough shape. Many are struggling, and a greater emphasis should be placed on that when evaluating an economy.

Figures 3 and 4: Richest 10% income share, 1980-2020

Sources: