Personal Updates:

A longer post is in the works (Topic - Tim Cook, CEO of Apple)

Not finance-related, but currently editing a video (Topic - Let It Be (1970): Movie Review)

To all of my new readers, be sure to follow my Twitter for real-time newsletter updates! You could enjoy posts like the one down below!

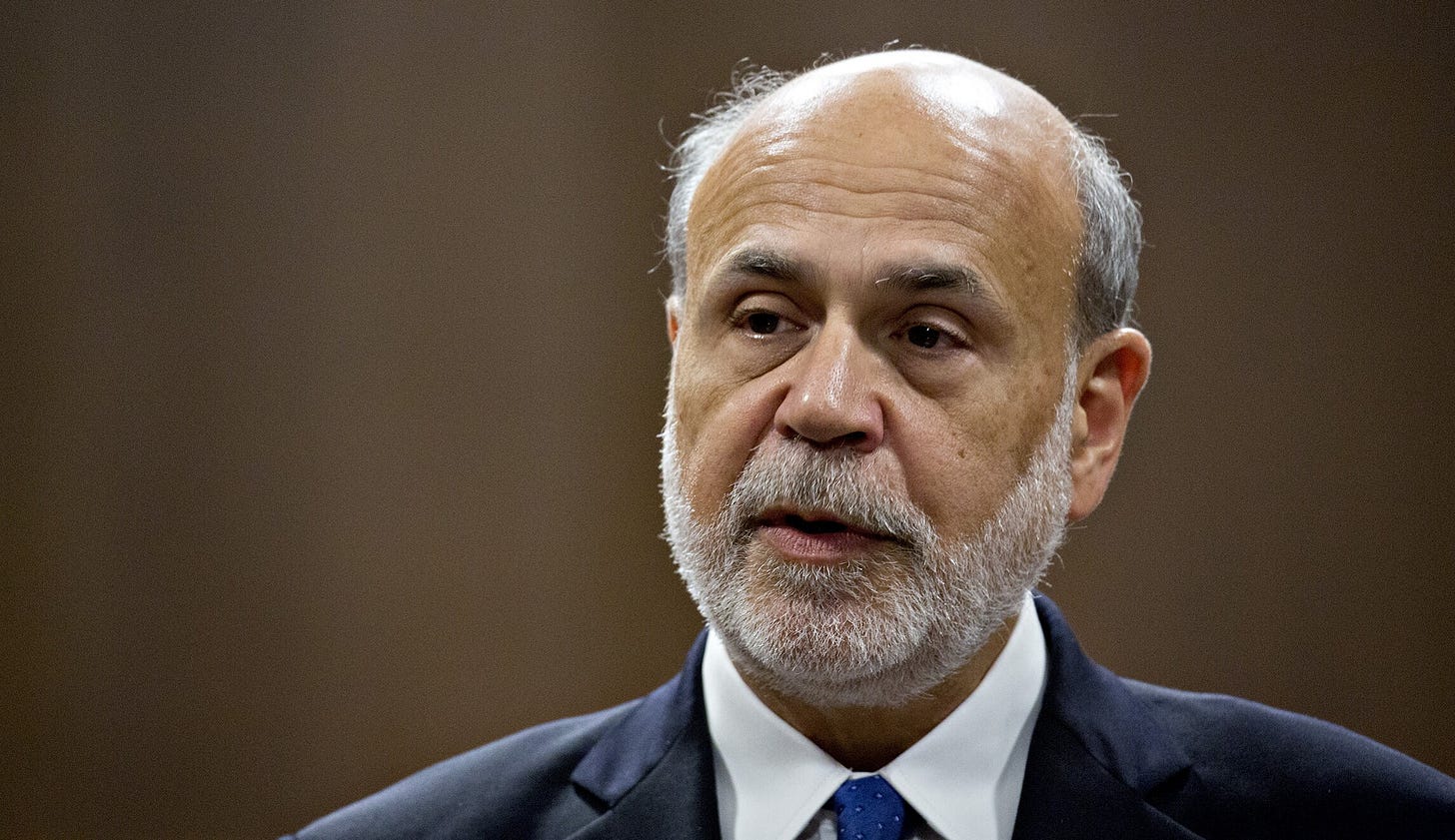

#1 - Most Nobel Laureates Develop Theories; Ben Bernanke Put His Into Practice

Ben Bernanke was awarded The Nobel Prize in Economic Sciences earlier this week for putting his economic theories “into practice” during the Great Recession of 2008. During this time, he used everything in the Federal Reserve’s toolbox to skirt an even deeper financial and economic disaster. Quantitative easing was one of these tools that Bernanke used to keep the economy afloat.

During this time, the US central bank increased the money supply by purchasing US treasury securities. Fast forwarding to today, people seem to be a lot more skeptical of quantitative easing (QE). This is mainly because of the persistently high levels of inflation after the Fed engaged in quantitative easing from March 2020 to March 2022.

It is certainly hard to say if QE is a dangerous tool. Given that this strategy has only been around for 14 years, I believe that this is too small of a sample size to determine its usefulness. Although, I think that leveraging QE during the Covid recession was still the right move. During a time of pure uncertainty, it provided some means of stability for the financial world.

Many of you will point out that QE created high inflation. Thus, causing the financial markets to be all over the place. So, is QE the sole reason to blame for the current financial instability? I think not.

#2 - ‘Growing wealth gap and rising inflation … hurt the global economy at almost every turn,’ Jamie Dimon says

Love or hate him, it is important to listen to Jamie Dimon. Being the CEO of JP Morgan inherently makes him one of the most important people in the banking world. In a recent conversation about the state of the economy, Dimon cites that “Over the past 25 years… the world has grown far more polarized and unstable”. As a result of this, he believes that the economy is hurting and becoming more volatile. The writer of the article, Mark DeCambre, then later writes that “These are uncertain times, and it might feel as if the world has never been more perplexing”.

Dear fellow reader, prepare for story time!

I started writing about financial news all the way back in May 2020. My Substack does not reflect that, but just take my word for it. Since becoming a writer, I feel almost desensitized to terms like “uncertainty” and “unprecedented”. I am partially at fault for this because it is VERY FUN to use those terms. Don’t believe me? Scroll back up to the Bernanke section. Anyways, uncertainty is never a good thing. Even in a more general sense, people just want stability. Yet, I barely blink an eye now when I come across “uncertainty” in a financial or economic article because I see it so often now. Is this because I am more experienced or just a pure fool? When contemplating that question, keep your answer to yourself so I can preserve my self-esteem.